Cookiebot: Your Key to Unlocking Advanced Tracking Features on Websites

Cookiebot: Your Key to Unlocking Advanced Tracking Features on Websites

Thrive in a Post-COVID World: The Future of Financial Institutions and Insurance Organizations

Eileen Potter

April 23, 2021

The pandemic forced financial institutions and insurance organizations to make overnight changes in how they operated, and for two industries not known for speed in adapting to change—or changing processes on the fly—this proved that they can be nimble when they need to be. It was almost like these established organizations had an overnight shift in culture, trading in their suits and ties for hoodies to become more accessible and focused on customer experience.

Many of the operational changes exposed gaps in existing digital capabilities, and some of these changes—like the shift to remote work and virtual customer engagement—appear to be settling in as the new normal.

According to a recent McKinsey study: Fully 75% of people using digital channels for the first time indicate that they will continue to use them when things return to “normal.”

While both industries were able to survive this year by making temporary fixes to processes so customer service wouldn’t suffer, it has become clear that there is a significant need to accelerate digital adoption and enhance virtual operations, finding better and more permanent solutions to address those gaps.

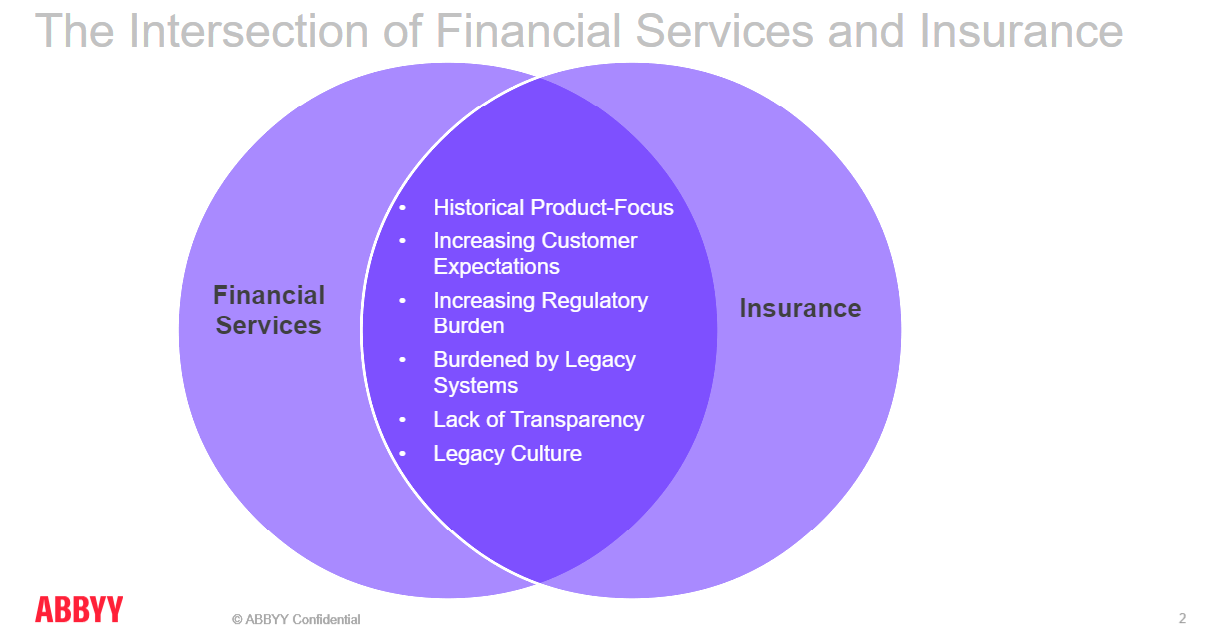

As part of a recent presentation we gave at OPEX Financial Services , my colleague, Cheryl Chiodi, and I put together a Venn Diagram to illustrate what we called “The Intersection of Financial Services and Insurance.” And the areas in common are exactly why both need to reset, reinvest, and reimagine their business operations to compete with Fintechs and Insurtechs, so they can be ready for what is next—and what will be the next after that—whatever that is.

So, how can established organizations in both industries thrive going forward? Here are three of the main challenges we see, and some of the ways organizations can respond:

Increasing customer expectations

It would not be an overstatement to say that customers have an expectation of now—and that their expectations are being set by their last, best digital experience. The time of rushing over to a bank branch or insurance office during “business hours” is long over, and hours of operation are no longer being set by the bank or the insurance company, but by the customer. They want to be able to communicate using their channel and device of choice, and they expect faster response times for policy quotes, claims settlement, and credit decisions. Streamlined account opening and onboarding are table stakes.

Forward-thinking organizations can facilitate this digital engagement with Process Intelligence , enabling them to personalize the customer journey and help to ensure customer loyalty.

Burdened by legacy systems and manual processes

Financial Services and Insurance are document-heavy, decision-based industries, running a complicated web of disparate, siloed systems and databases. The result? A lack of visibility into how processes are working today and where the inefficiencies and bottlenecks are. Digitizing processes and innovating with technologies like artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and natural language processing (NLP) will enable them to accelerate the response to business and market changes, and improve process efficiency for both internal and external stakeholders.

Evolving regulatory landscape

While both industries have always been heavily regulated, the new level of remote work has placed an increased focus on data governance due to privacy laws. There is a renewed emphasis on enabling a level of visibility into audit processes and provide controls through monitoring and alerting, ensuring an accurate, aggregated view of risk across the business.

It’s not exactly breaking news to talk about how much the business landscape for both industries has evolved over the past several years, and the pace of change only seems to be accelerating. If 2020 taught us anything, it’s that agility and resilience are critical to successfully navigating those changes. Financial institutions and insurance organizations need to cultivate both as part of their company culture going forward so they can thrive in 2021, and beyond.

Watch our recent session at OPEX Financial Sessions to see how Digital Intelligence can help reduce friction and simplify processes.

Intelligent Automation Insurance Financial Services Coronavirus

Eileen Potter

Like, share or repost

Share

Subscribe for blog updates

First name*

E-mail*

Сountry*

СountryAfghanistanAland IslandsAlbaniaAlgeriaAmerican SamoaAndorraAngolaAnguillaAntarcticaAntigua and BarbudaArgentinaArmeniaArubaAustraliaAustriaAzerbaijanBahamasBahrainBangladeshBarbadosBelgiumBelizeBeninBermudaBhutanBoliviaBonaire, Sint Eustatius and SabaBosnia and HerzegovinaBotswanaBouvet IslandBrazilBritish Indian Ocean TerritoryBritish Virgin IslandsBrunei DarussalamBulgariaBurkina FasoBurundiCambodiaCameroonCanadaCape VerdeCayman IslandsCentral African RepublicChadChileChinaChristmas IslandCocos (Keeling) IslandsColombiaComorosCongo (Brazzaville)Congo, (Kinshasa)Cook IslandsCosta RicaCroatiaCuraçaoCyprusCzech RepublicCôte d’IvoireDenmarkDjiboutiDominicaDominican RepublicEcuadorEgyptEl SalvadorEquatorial GuineaEritreaEstoniaEthiopiaFalkland Islands (Malvinas)Faroe IslandsFijiFinlandFranceFrench GuianaFrench PolynesiaFrench Southern TerritoriesGabonGambiaGeorgiaGermanyGhanaGibraltarGreeceGreenlandGrenadaGuadeloupeGuamGuatemalaGuernseyGuineaGuinea-BissauGuyanaHaitiHeard and Mcdonald IslandsHoly See (Vatican City State)HondurasHong Kong, SAR ChinaHungaryIcelandIndiaIndonesiaIraqIrelandIsle of ManIsraelITJamaicaJapanJerseyJordanKazakhstanKenyaKiribatiKorea (South)KuwaitKyrgyzstanLao PDRLatviaLebanonLesothoLiberiaLibyaLiechtensteinLithuaniaLuxembourgMacao, SAR ChinaMacedonia, Republic ofMadagascarMalawiMalaysiaMaldivesMaliMaltaMarshall IslandsMartiniqueMauritaniaMauritiusMayotteMexicoMicronesia, Federated States ofMoldovaMonacoMongoliaMontenegroMontserratMoroccoMozambiqueMyanmarNamibiaNauruNepalNetherlandsNetherlands AntillesNew CaledoniaNew ZealandNicaraguaNigerNigeriaNiueNorfolk IslandNorthern Mariana IslandsNorwayOmanPakistanPalauPalestinian TerritoryPanamaPapua New GuineaParaguayPeruPhilippinesPitcairnPolandPortugalPuerto RicoQatarRomaniaRwandaRéunionSaint HelenaSaint Kitts and NevisSaint LuciaSaint Pierre and MiquelonSaint Vincent and GrenadinesSaint-BarthélemySaint-Martin (French part)SamoaSan MarinoSao Tome and PrincipeSaudi ArabiaSenegalSerbiaSeychellesSierra LeoneSingaporeSint Maarten (Dutch part)SlovakiaSloveniaSolomon IslandsSouth AfricaSouth Georgia and the South Sandwich IslandsSouth SudanSpainSri LankaSurinameSvalbard and Jan Mayen IslandsSwazilandSwedenSwitzerlandTaiwan, Republic of ChinaTajikistanTanzania, United Republic ofThailandTimor-LesteTogoTokelauTongaTrinidad and TobagoTunisiaTurkeyTurks and Caicos IslandsTuvaluUgandaUkraineUnited Arab EmiratesUnited KingdomUnited States of AmericaUruguayUS Minor Outlying IslandsUzbekistanVanuatuVenezuela (Bolivarian Republic)Viet NamVirgin Islands, USWallis and Futuna IslandsWestern SaharaZambiaZimbabwe

I have read and agree with the Privacy policy and the Cookie policy .

I agree to receive email updates from ABBYY Solutions Ltd. such as news related to ABBYY Solutions Ltd. products and technologies, invitations to events and webinars, and information about whitepapers and content related to ABBYY Solutions Ltd. products and services.

I am aware that my consent could be revoked at any time by clicking the unsubscribe link inside any email received from ABBYY Solutions Ltd. or via ABBYY Data Subject Access Rights Form .

Referrer

Last name

Query string

Product Interest Temp

UTM Campaign Name

UTM Medium

UTM Source

ITM Source

GA Client ID

UTM Content

GDPR Consent Note

Captcha Score

Page URL

Connect with us

Also read:

- [New] In 2024, Decoding the Underlying Messages in Snapchat's Symbolic Language

- [Updated] The Jaunt VR Journey Explained

- 2024 Approved Android Music Integration A Guide to Social Media Playlists

- Complete Tutorial to Use GPS Joystick to Fake GPS Location On Vivo Y36i | Dr.fone

- How to Get Minecraft LAN Parties Up and Running Again

- How to Simulate GPS Movement in AR games On Vivo V27 Pro? | Dr.fone

- In 2024, How To Simulate GPS Movement With Location Spoofer On Realme Narzo 60 5G? | Dr.fone

- Transforming Legal Text Analysis with ABBYY's Advanced Docs: Enhanced Capabilities and Seamless RAG Sync

- Understanding the Distinctions Between Process Intelligence and BI Techniques for Strategic Decision-Making

- Unlocking Features of FineScanner in iOS 12 - Expert Insights From the ABBYY Community

- Utilizing Cookiebot Technology for Improved Online Engagement Analysis

- Windows Camera Issues Decoded: Understanding and Fixing Error 0xA00F4292

- Title: Cookiebot: Your Key to Unlocking Advanced Tracking Features on Websites

- Author: Paul

- Created at : 2024-10-13 00:52:25

- Updated at : 2024-10-14 16:49:43

- Link: https://solve-marvelous.techidaily.com/cookiebot-your-key-to-unlocking-advanced-tracking-features-on-websites/

- License: This work is licensed under CC BY-NC-SA 4.0.